- Number of remortgage deals increase 41% – from 28,400 in December 2016 to 39,943 in December 2017

- Demand for variable remortgages falls to 2% in wake of rate rise – a new low

The number of remortgages has risen 41% year-on-year from 28,400 in December 2016 to 39,943 in December 2017 according to conveyancing service provider, LMS.

Following the increase in the base rate to 0.5% in November last year, the majority of lenders passed on the full 0.25% rise and also increased their standard variable rates. Around 8.1 million UK households have a mortgage, and of those almost half are on either a standard variable rate or a tracker rate. In the current climate, borrowers’ motivation to remortgage has hit its highest level since the financial crisis.

Nick Chadbourne, chief executive of LMS, said: “We are still in a ’settling-in‘ period – borrowers and lenders have yet to fully acclimatise to the current situation. But rising interest rates on trackers and standard variable rate mortgages are driving remortgage activity with borrowers highly motivated to remortgage. In this busy climate, all the stakeholders in the mortgage industry need to do what they can to make the borrowing process as simple and straightforward for consumers as possible. LMS continues to create more efficiencies to speed up and streamline the remortgage process and we’ve already invested in our technology as well as our headcount to cope with the amount of business we’re seeing.”

The rise in activity in December is likely to continue in the coming months as the base rate is predicted to rise again. In November 2017, Bank of England Governor Mark Carney said two more base rate rises were likely by the end of 2020. While the Bank kept rates on hold in February, the MPC has stressed that it sees a need for monetary policy to tighten more rapidly than it did three months before. The markets are now pricing-in the next base rate rise to occur as soon as May and for there to be at least three rate increases over the next three years. Research conducted by LMS suggests that 82% of borrowers now expect an imminent rise.

Chadbourne added: “The talk of further base rate increases will no doubt continue to stimulate the market over the coming weeks.

VARIABLE RATE VS. FIXED RATE

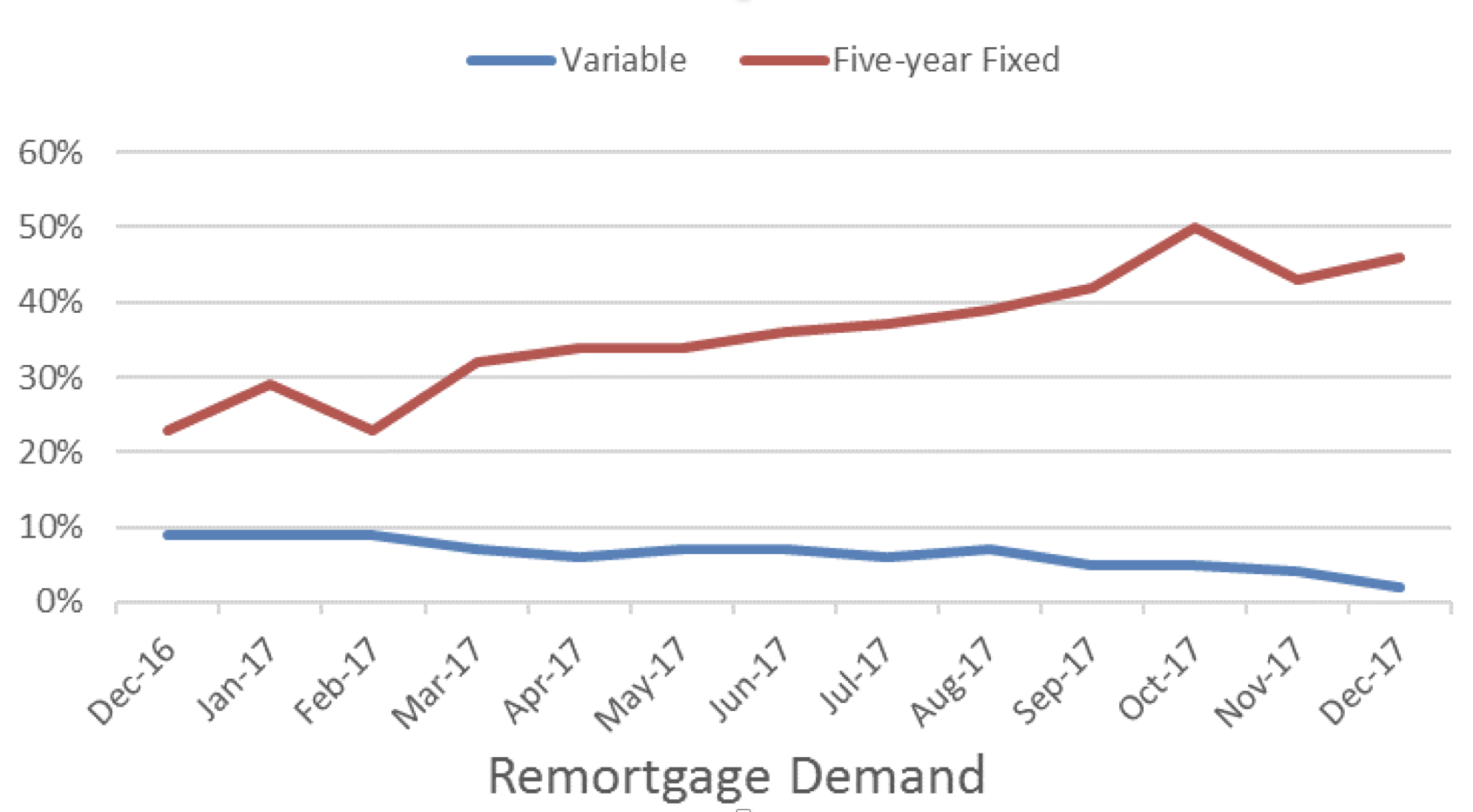

November’s rate hike is also shaping borrower appetite with demand for variable rate products falling to just 2% of the remortgage market in December 2017 – a sharp drop from the 9% in December 2016 and a new low. Demand for five-year fixed products has risen, making up 46% of recent remortgages, double the 23% market share seen in December 2016.

Chadbourne said: “With the base rate having risen for the first time in 10 years, borrowers have started looking for greater security. Product requirements have therefore had to change, with lenders adapting to a shift in the market and the dwindling popularity of variable rate products. While variable rate products are versatile and provide a level of flexibility that might have appealed to borrowers when the base rate was falling, in the current climate of rising rates, the security offered by fixed-rate products is the natural choice for many now. Borrowers have been primed to expect a higher cost of borrowing and they are opting to secure their position and eliminate risk where possible.”

INCREASE IN VOLUME OF BUY-TO-LET REMORTGAGES

The popularity of two-year fixed rate remortgage deals also increased, rising from a low of 20% of remortgages in October 2017 to 23% in November and December.

In the run up to the introduction of the 3% Stamp Duty surcharge on additional homes in April 2016, investment in the buy-to-let sector increased. Indeed, in December 2015, Connells Survey & Valuations reported the number of buy-to-let valuations they carried out had risen by 86% compared to the previous year – as landlords raced to secure properties before the tax changes took hold. Given the cheapest buy-to-let mortgage rates are found on two-year fixes, landlords are now renewing these deals.

Chadbourne concluded: “At the end of 2015, buy-to-let investors were racing against the clock to make sure they didn’t fall foul of the 1st April Stamp Duty deadline – it was critical purchasers finalised their transactions before being hit by the 3% surcharge. With the popularity of two-year fixed rate mortgages with landlords, that caused a spike in the market which is now working its way through the system as these deals come to an end. Even with the new interest rate environment driving the popularity of five-year – rather than two-year – fixes, we’ve still seen an increase in their popularity recently.”