21st

December

2018 – The year of the Product Transfer

2018 In Review

£150 bn

value of mortgage debt transferred internally in 2018

1,155,000

number of product transfers in 2018

£70 bn

value of mortgage debt transferred internally on a non-advised basis

47%

Proportion of product transfers undertaken on a non-advised basis

3%

rates of non-advised mortgage sales in the wider market (inc remortgage)

Forecasts for 2018

£150 bn

value of mortgage debt transferred internally in 2018

1,155,000

number of product transfers in 2018

£70 bn

value of mortgage debt transferred internally on a non-advised basis

47%

Proportion of product transfers undertaken on a non-advised basis

3%

rates of non-advised mortgage sales in the wider market (inc remortgage)

The residential product transfers market will break the £150bn mark by the end of 2018, according to new research from LMS.

According to analysis of industry data undertaken by LMS, 1,155,000 homeowners will switch products with their existing provider over the course of 2018 – representing over £150 billion of mortgage debt refinanced internally.

But LMS forecasts that only 610,000 of those transfers, worth £80 billion, will be conducted on an advised basis. This means that, over the course of 2018, almost half (47%) of product transfers will have taken place on an execution basis, without advice.

LMS says this represents an “advice gap” in the remortgage process – especially given the rise in advice across the wider market.

510,000

Borrowers stuck in the product transfer advice gap over 2018

510,000

Product transfers became one of the most important drivers of the remortgage market in 2018. November 2017 saw the first rate rise in over ten years. That triggered consumers to act to secure new deals as their current fixed rate products concluded. The product transfer market has been further fueled by changes to brokers’ proc fees, which are incentivising intermediaries to contact their customers before their current mortgage deal expires; and by lenders contacting their customers well in advance of deals coming to an end.

Nick Chadbourne, chief executive of LMS said: “Our research suggests that over the course of the year, 545,000 borrowers are going to have undertaken an execution only product transfer. If you compare that to the wider mortgage sales market, it appears to be about 510,000 too many. In a rising rate environment, consumers appear to have opted for the perceived quickest route. But a mass volume of products selected without advice represents a significant gap in the amount of advice borrowers are getting when they remortgage.

“It’s a common misconception that selecting a new product triggers vast legal work and expanded timeline. Many products are offered with Free Legals – specifically designed to ensure the appropriate legal work is undertaken to protect both the consumer and lender, using a process that is quick and efficient.

“Consumers need to be aware of this when making their decision and should take advice that ensures they have selected the best product most suitable for their needs. Even a 0.25% saving on a £150,000 mortgage could save borrowers a meaningful amount of money over the course of the deal. The product transfer advice gap represents a missed opportunity for borrowers.”

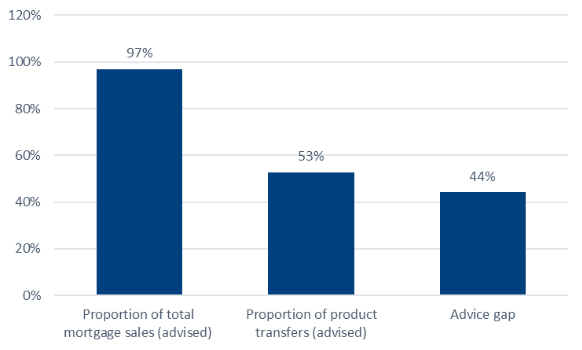

The rates of non-advised product transfers do not reflect the available rates within the wider mortgage market. The number of non-advised mortgage sales (which includes remortgages) has dropped significantly in the decade since the financial crash – falling from 35% of sales in Q2 2008 to just 3% in Q2 2018, suggesting another 44% of product transfers should be advised.

CHART 1: Proportion of sales by advice given

Nick Chadbourne said: “Full advice is not just about the cheapest rate. It’s about the path, the aspirations, and the intentions of borrowers. Ideally, we’d like to see more borrowers consulting brokers even if, on the surface, it doesn’t seem that much has changed since they secured their last mortgage. While an execution-only product transfer might look like the easiest route to remortgage, it’s still worth seeking advice – it’s an opportunity for borrowers to consult a broker and search the market more fully.”

INTEREST RATE EXPECTATIONS: 2017 vs 2018

For further information please call James Staunton or Amy Drawbell on 0207 457 2020 or email LMS(Replace this parenthesis with the @ sign)instinctif.com

LENDER FEES & FEES ASSISTED REMORTGAGES

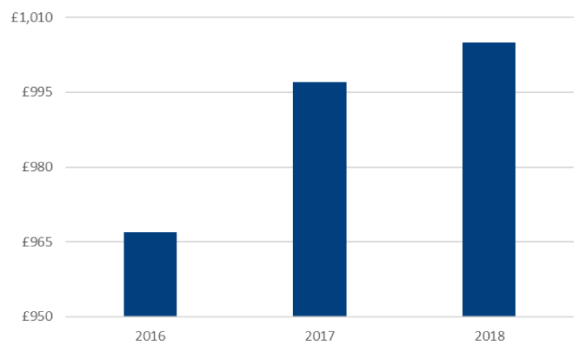

Lender fees appear to be on the rise with the average mortgage fee reaching more than £1,000 for the first time since August 2013 – despite lenders cutting rates and pushing other incentives to stay competitive after the August interest rate rise.

CHART 2: Average mortgage fee charged by lenders (£)

2018 also saw lenders favour the fees assisted model for legal services in the search for market share. And free legals on remortgages remain popular with borrowers with four times as many remortgage customers choosing a free legal option, rather than cash back.

Nick Chadbourne said: “The benefits of fees assisted remortgages are that they are simple and easy. Fees assisted products are also popular with borrowers trying to minimise outgoings when they are looking to spend elsewhere – such as when they are remortgaging to release cash to build a new extension to their home. They work well for borrowers with relatively small amounts left on their mortgages – consumers who may otherwise be put off remortgaging because of the switching costs. By utilising brokers and the professional advice that is available, consumers can assess the market to decide if a fees assisted product is right for them.”

TECHNOLOGICAL INNOVATION & OPEN BANKING

The industry has also entered the era of Open Banking, with consumers able to share their current account data with third parties; a development that will soon transfer to mortgage data. Other interesting developments in the space include the second year of the Land Registry’s groundbreaking ‘Digital Street’ project. This is investigating how technology can be used make it simpler, quicker and cheaper to buy or sell property. Digital Street is looking to do this by connecting conveyancers, lenders, PropTech companies, data providers and the public. The Land Registry is continuing to explore how new technologies like blockchain and distributed ledgers (secure, online databases allowing everyone involved in a transaction to clearly see the track the status of the sale) can be used to develop a simpler, faster and cheaper land registration process. The project is now set to explore how smart contracts (digital contracts that automatically complete once everyone involved has filled out their section) and advancing digital signature technology (allowing individuals to sign documents online), can be used to improve the Land Register.

DIGITAL ADVANCES HIGH ON THE AGENDA FOR ALL IN BOTH 18/19

LMS introduced innovative new technology to its conveyancing offering, e-COT. These improvements helped shorten timeframes, reduce risk, and increase certainty of documentation delivery within the process by letting law firms send certificates of title digitally, rather than by post, fax, or email. e-COT also offers authentication of senders and receivers as part of client account verification process, mitigating the risk of fraud. While major lenders including NatWest and RBS were the first to use e-COT, LMS will be rolling out the service to more lenders throughout 2019.

Mike Hughes chief technology officer at LMS said: “While LMS has made progress throughout the year, we’re an innovative technology company and our plans have only just started with the launch of e-COT. 2019 will see the continued evolvement of conveyancing technology; the industry still needs to do more to join-up the dots and improve the completion journey and brokers’ concerns are at the forefront of our minds.

“We are preparing further innovations that will improve and speed up the conveyancing experience. We will be looking at automated redemption statements to reduce the costs of people leaving lenders and speeding up the remortgage process. LMS will utilise API’s to speed up the process and allow redemption statements to be delivered in real-time, sending them straight into case management systems.

“We also want to introduce a fraud checker that will test the background of lawyers in receipt of wired money by collating bank account and sort code information on firms onto one system. Watch this space. If 2018 was the year of the product transfer, 2019 will be the year of the remortgage revolution.”

Posted:21/12/18