24th

October

More customers using brokers to secure remortgage deals

- 85% of borrowers expect interest rates will rise compared to 45% in August 2017

- 88% of borrowers consult a broker when remortgaging, up from 75% in July 2018

- 91% of borrowers felt brokers offer good value – compared to just 86% in July

- Average remortgage loan amount breaks last month’s record reaching £173,545

- The average volume of remortgage loans also hits a new high at 38,000

Despite recent rate rises, customers are still securing good deals, especially those consulting brokers. The number of borrowers consulting a broker has increased by 13% since July to 88%, according to LMS, the conveyancing service provider. As a result, the number of people able to lower their monthly mortgage repayments increased from 11% in July to 16% in August.

This reflects broker’s rising popularity amongst borrowers with 91% saying they thought brokers were good value for money compared to 86% in July.

Both the average remortgage loan amount and the average volume of remortgage loans have broken last month’s records reaching £173,545 and 38,000 respectively.

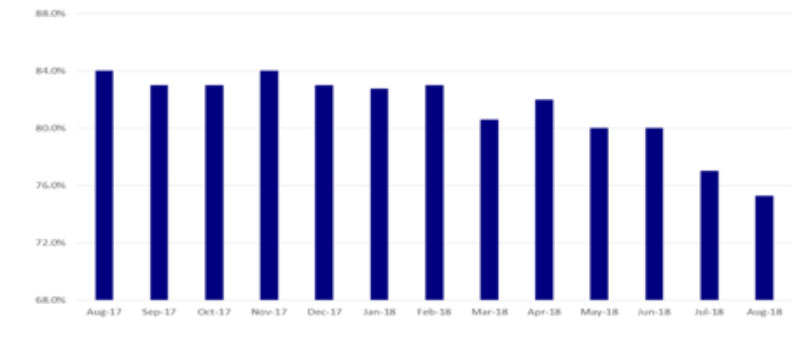

However, the number of borrowers who were able to lower their mortgage rate in August has fallen slightly since July, from 77% to 75%. This is the lowest amount of borrowers since August 2017 and signifies a more challenging remortgage market.

FIGURE 1: PERCENTAGE OF BORROWERS ABLE TO LOWER THEIR MORTGAGE RATE

Nick Chadbourne, chief executive of LMS, said: “Borrowers are proactively obtaining advice from brokers in order to successfully navigate a tougher rates environment, with 88% of remortgagers now consulting an intermediary. As a result, borrowers are still getting good deals and more people are seeing their mortgage payments fall; remortgaging presents a moment in time where individual circumstances and aspirations can be understood and that’s the value of obtaining advice from a broker. Intermediaries are adding value to the decision-making process by providing an in depth understanding of the market and lender rate tables. This is reflected in borrowers’ increasing positive opinion of brokers.

“Fewer borrowers feel confident about making a decision without advice and more are stating broker advice is the most important factor when selecting a new lender.”

BORROWERS INCREASINGLY VALUING BROKERS

Brokers are increasingly regarded as good value for money: 91% of borrowers reached this consensus in August, up from 86% in July.

Fewer borrowers said the most important factor affecting choosing a new lender was the best rate (47% down from 53%). There is a growing understanding in the current market that finding the right product is more complicated than looking at the headline rate which is why more people are turning towards brokers.

Fewer borrowers feel confident enough to make a decision about their remortgage without advice (from 93% to 84%) and 37% of borrowers say broker advice is the most important factor when choosing a new lender, up from 34% in July.

Nick Chadbourne said: “As rates rise it is becoming increasingly evident that borrowers are looking to seek advice from intermediaries. This month’s data indicates a direct correlation between the rise in borrowers consulting brokers and those able to lower their monthly mortgage repayments. This demonstrates the value of broker advice when remortgaging. Brokers can provide clarity around the true value of mortgage deals and identify deals with valuable extras for borrowers such as free legals. The number of borrowers who feel confident enough to go through the remortgaging process without advice is in decline: brokers are stepping in to fill the gap in consumer confidence caused by an ever more complicated market.”

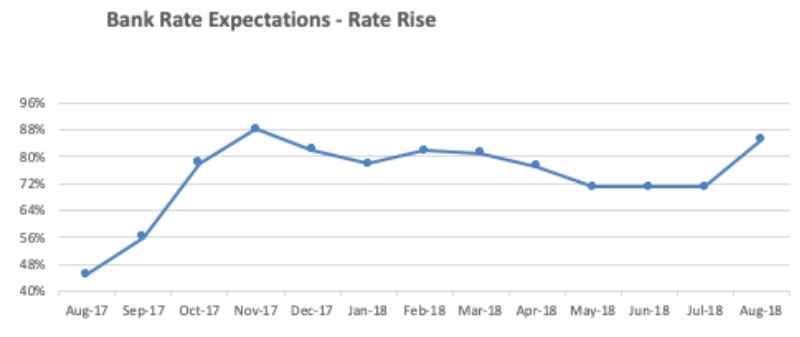

BORROWERS EXPECT RATES TO RISE

LMS polled borrowers about their interest rate expectations and 85% of borrowers predict the bank rate will rise in the next year, up from just 45% in August 2017. This explains why the popularity of fixed rate products remains undiminished.

FIGURE 2: BANK RATE EXPECTATIONS

Nick Chadbourne said: “Following the increase in August of the Bank of England’s base rate of interest from 0.5% to 0.75%, borrowers are predicting further rises. This is reflected in their choice of mortgage product, with the majority opting for fixed rate mortgages.”

FIXED RATE PRODUCTS REMAIN POPULAR WITH BORROWERS

When borrowers were asked what their previous mortgage product type was, 49% said they were coming off a fixed 2 year mortgage. Only 8% were on a fixed 5 year mortgage. While 26% moved on to a fixed 2 year mortgage in August, 34% moved on to a fixed 5 year mortgage.

The mix of fixed rate products is changing. In July approximately 65% of new fixed rate mortgages were 5 year products. That’s now fallen to approximately 55%.

Nick Chadbourne said: “This shift towards an equal proportion of borrowers choosing either 2 or 5 year rate fixed mortgages reflects a change in pricing, as rates for longer term fixes rise.”

Download the full Remortgage report here

Posted:24/10/18